Essay

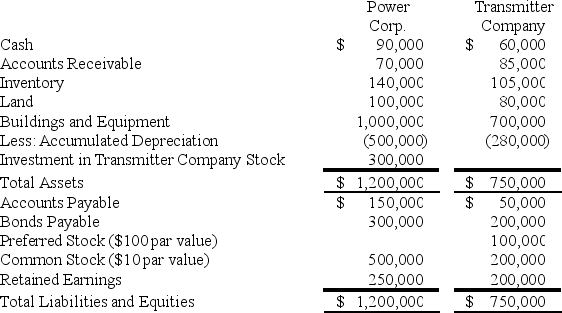

Power Corporation owns 75 percent of Transmitter Company's common stock.At the date of acquisition the fair value of the noncontrolling interest was equal to the book value of Transmitter Company's common stock.The following balance sheet data are presented for December 31,20X8:

Transmitter reported net income of $90,000 in 20X8 and paid dividends of $30,000.Its bonds have an annual interest rate of 10 percent and are convertible into 12,000 common shares.Its preferred shares pay a 12 percent annual dividend and convert into 5,000 shares of common stock.In addition,Transmitter has warrants outstanding for 12,000 shares of common stock at $15 per share.The 20X8 average price of Transmitter common shares was $25.

Power reported income of $180,000 from its own operations for 20X8 and paid dividends of $40,000.Its 9 percent bonds convert into 8,000 shares of its common stock.The companies file separate tax returns and are subject to income taxes of 40 percent.

Required:

Compute basic and diluted earnings per share for the consolidated entity for 20X8.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Sigma Company develops and markets organic food

Q27: Power Corporation's controller has just finished preparing

Q28: Power Corporation's controller has just finished preparing

Q29: Plush Corporation holds 80 percent of Scratch

Q30: Company P holds 70 percent of the

Q32: Pappas Company owns 85 percent of Sunny

Q33: Which of the following observations concerning the

Q34: Plywood Corporation's consolidated cash flow statement for

Q35: Pappas Company owns 85 percent of Sunny

Q36: Pure Life Corporation has just finished preparing