Essay

On July 1st,Smith Corporation purchased $10,000 of inventory using a short-term note payable due in one year at 10% interest.Smith Corporation's fiscal year ends on December 31.

Required:

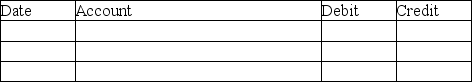

1.Journalize the purchase of the inventory.Omit explanation.

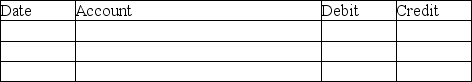

2.Journalize the accrued interest expense on December 31st.Omit explanation.

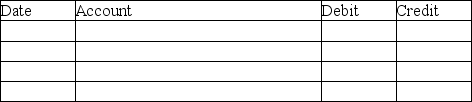

3.Journalize the payment of the note payable the following year on June 30th.Omit explanation.

1.

2.

2.

3.

3.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: The accounts payable turnover expressed in days

Q27: Companies with longer payment periods are usually

Q28: An example of a contingent liability may

Q29: Long-term liabilities are mostly for:<br>A)operating activities<br>B)financing activities.<br>C)investing

Q30: Potential liabilities that depend on future events

Q32: To accrue a contingent liability means to:<br>A)report

Q33: Current liabilities are expected to be paid

Q34: On April 1st,Jones Corporation purchased $15,000 of

Q35: If the accounts payable turnover is 7.9,what

Q36: The current portion of a long-term note