Essay

On April 1st,Jones Corporation purchased $15,000 of inventory using a short-term note payable due in one year at 8% interest.Jones Corporation's fiscal year ends on December 31.

Required:

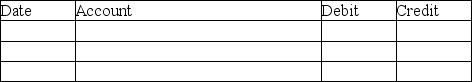

1.Journalize the purchase of the inventory.Omit explanation.

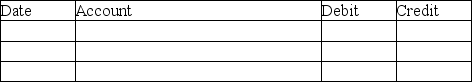

2.Journalize the accrued interest expense on December 31st.Omit explanation.

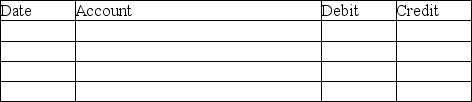

3.Journalize the payment of the note payable the following year on March 31st.Omit explanation.

1.

2.

2.

3.

3.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Long-term liabilities are mostly for:<br>A)operating activities<br>B)financing activities.<br>C)investing

Q30: Potential liabilities that depend on future events

Q31: On July 1st,Smith Corporation purchased $10,000 of

Q32: To accrue a contingent liability means to:<br>A)report

Q33: Current liabilities are expected to be paid

Q35: If the accounts payable turnover is 7.9,what

Q36: The current portion of a long-term note

Q37: Contingent liabilities can never be long term.

Q38: When calculating accounts payable turnover,if there is

Q39: On December 31st,Smith Corporation has cost of