Essay

Steve's Hardware Store uses the perpetual inventory system.The business incurred the following transactions:

A.On November 1,10 snow blowers were purchased on account at $1,000 each.Credit terms were 2/10,net 30.

B.On November 2,the business returned two snow blowers due to damage incurred in shipping.

C.On November 10,the business sold three of the snow blowers on account at $1,500 each.The credit terms were 2/10,net 30.No sales returns are expected.

D.On November 12,the business paid for the snow blowers.

E.On November 30,the business paid wages of $2,000.

Required:

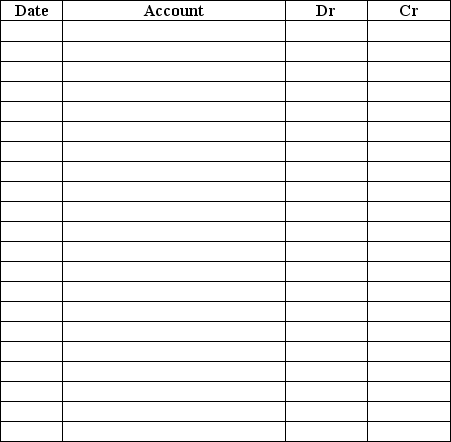

Journalize the above transactions for Steve's Hardware Store.Explanations are not required.

Correct Answer:

Verified

*Before the sale on Nov.10,there were 8...

*Before the sale on Nov.10,there were 8...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Gross profit will be the:<br>A)highest if LIFO

Q35: Lower-of-cost-or-market requires that LIFO inventory be reported

Q36: Beginning inventory for the year ended December

Q37: Roadway Company purchases inventory from Fedway Company

Q38: When comparing the FIFO and LIFO inventory

Q40: The units of inventory available for sale

Q41: To determine the cost of ending inventory

Q42: Using the following data,by how much would

Q43: Kennel Company reported the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6907/.jpg"

Q44: The inventory turnover ratio:<br>A)is determined by dividing