Multiple Choice

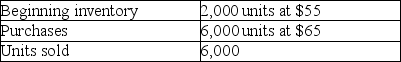

Using the following data,by how much would taxable income change if LIFO is used rather than FIFO?

A) There is no difference.

B) Increase by $20,000.

C) Decrease by $20,000.

D) Decrease by $60,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Roadway Company purchases inventory from Fedway Company

Q38: When comparing the FIFO and LIFO inventory

Q39: Steve's Hardware Store uses the perpetual inventory

Q40: The units of inventory available for sale

Q41: To determine the cost of ending inventory

Q43: Kennel Company reported the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6907/.jpg"

Q44: The inventory turnover ratio:<br>A)is determined by dividing

Q45: On June 1,Neighbor Company purchased inventory on

Q46: Given the following data,calculate the cost of

Q47: If ending inventory for a year is