Multiple Choice

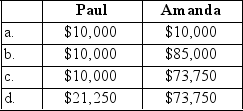

Paul invests $10,000 cash in an equipment leasing activity for a 15% ownership share in the business.The remaining 85% owner is Amanda.Amanda contributes $10,000 and personally borrows $75,000 that she also invests in the business.What are the at-risk amounts for Paul and Amanda?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q5: What form must a taxpayer file if

Q7: If a loss is disallowed under passive

Q8: The term "active participation" is used to

Q9: AMT depreciation of personal property is calculated

Q12: Stuart owns a 20% interest in a

Q13: Randall invested $200,000 in Activity A and

Q14: Baird has four passive activities.The following income

Q15: After computing all tax preferences and AMT

Q19: To be considered a material participant in

Q68: Two equal partners involved in a passive