Essay

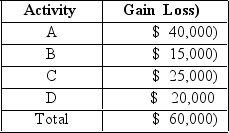

Baird has four passive activities.The following income and losses are generated in the current year.

How much of the $60,000 net passive loss can Baird deduct this year? Calculate the suspended losses by activity).

How much of the $60,000 net passive loss can Baird deduct this year? Calculate the suspended losses by activity).

Correct Answer:

Verified

The passive losses can offset ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: There is no difference between regular tax

Q6: Oliver has an $80,000 loss from an

Q9: AMT depreciation of personal property is calculated

Q10: Paul invests $10,000 cash in an equipment

Q12: Stuart owns a 20% interest in a

Q13: Randall invested $200,000 in Activity A and

Q15: After computing all tax preferences and AMT

Q17: Bailey owns a 20% interest in a

Q18: Jordan purchased a warehouse for $600,000.$100,000 of

Q19: To be considered a material participant in