Multiple Choice

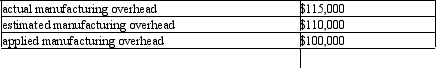

The Sterling Company applies manufacturing overhead. At the end of the year the following data were available:  The following accounts had the unadjusted balances:

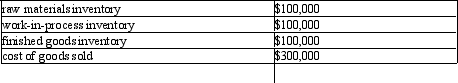

The following accounts had the unadjusted balances: What is the journal entry if the amount is considered material?

What is the journal entry if the amount is considered material?

A) Work in Process $ 1,000 Finished Goods $ 1,000

Cost of goods sold $ 3,000

Manufacturing overhead $5,000

B) Work in Process $ 3,000 Finished Goods $ 3,000

Cost of goods sold $ 9,000

Manufacturing overhead $15,000

C) Manufacturing Overhead $5,000 Work in Process $ 1,000

Finished Goods $ 1,000

Cost of goods sold $ 3,000

D) Manufacturing Overhead $15,000 Work in Process $ 3,000

Finished Goods $ 3,000

Cost of goods sold $ 9,000

E) none of these

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Material amounts of underapplied or overapplied overhead

Q33: The simple list of activities identified in

Q47: If applied overhead is greater than actual

Q119: The Anchorage plant of the Tundra Company

Q120: Figure 4-16 Samson Company recently installed an

Q122: Figure 4-21 Appleby Manufacturing uses an activity-based

Q125: Figure 4-16 Samson Company recently installed an

Q126: Figure 4-7 The Cherokee Company uses a

Q128: Figure 4-17 X-TREME Corporation has the following

Q185: A(n) _ is a grouping of logically