Essay

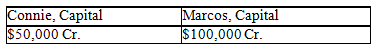

Connie and Marcos are partners who share profits in a ratio of 3:2,respectively,and have the following capital balances on September 30,20x5: The partners agree to admit Trevor to the partnership.Calculate the capital balances of each partner after the admission of Trevor,assuming that bonuses are recorded when appropriate for each of the following assumptions:

The partners agree to admit Trevor to the partnership.Calculate the capital balances of each partner after the admission of Trevor,assuming that bonuses are recorded when appropriate for each of the following assumptions:

a.Trevor pays Connie $50,000 for 50 percent of her interest

b.Trevor invests $50,000 for a one-fourth interest in the partnership

c.Trevor invests $50,000 for a 30 percent interest in the partnership

d.Trevor invests $50,000 for a 20 percent interest in the partnership

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Accounting for a partnership comes closer to

Q11: A partnership agreement should include the method

Q21: The division of income is one area

Q36: Liabilities related to assets invested in a

Q86: As long as the action is within

Q96: A liquidation differs from a dissolution in

Q98: Erin,Rachel,and Travis are partners in ERT Company,with

Q99: If a partnership agreement does not specify

Q102: Unlimited liability refers to<br>A)a claim to the

Q127: A partner invests into a partnership a