Essay

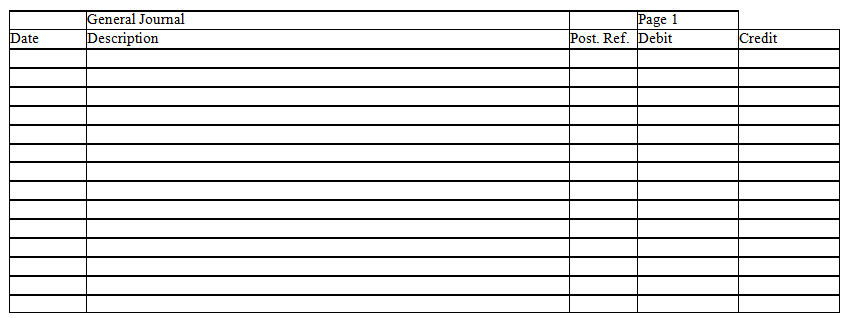

Erin,Rachel,and Travis are partners in ERT Company,with average capital balances for the year of $60,000,$80,000,and $40,000,respectively.They share remaining income in a 2:5:3 ratio,respectively,after each receives a $30,000 salary and 10 percent interest on his or her average capital balance.In the journal provided,prepare the entries without explanations to close income into their Capital accounts,assuming net income of $148,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Accounting for a partnership comes closer to

Q21: The division of income is one area

Q36: Liabilities related to assets invested in a

Q86: As long as the action is within

Q93: Partners A and B receive a salary

Q94: Jacob and Megan are partners who share

Q96: A liquidation differs from a dissolution in

Q99: If a partnership agreement does not specify

Q102: Unlimited liability refers to<br>A)a claim to the

Q103: When individuals invest property in a partnership,the