Multiple Choice

Millie,age 80,is supported during the current year as follows:  During the year,Millie lives in an assisted living facility.Under a multiple support agreement,indicate which parties can qualify to claim Millie as a dependent.

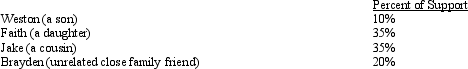

During the year,Millie lives in an assisted living facility.Under a multiple support agreement,indicate which parties can qualify to claim Millie as a dependent.

A) Weston,Faith,Jake,and Brayden.

B) Faith and Brayden.

C) Weston and Faith.

D) Faith,Jake,and Brayden.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: It is possible for an individual taxpayer

Q39: Logan,an 80-year-old widower,dies on January 2,2010.Even though

Q40: Which,if any,of the statements regarding the standard

Q41: Kyle,whose wife died in December 2007,filed a

Q42: Warren,age 17,is claimed as a dependent by

Q44: In terms of the tax formula applicable

Q45: Wilma is a widow,age 80 and blind,who

Q47: During 2010,Trevor has the following capital transactions:

Q55: A dependent cannot claim a personal exemption

Q127: Mel is not quite sure whether an