Multiple Choice

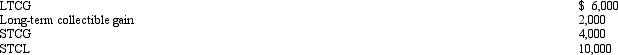

During 2010,Trevor has the following capital transactions:  After the netting process,the following results:

After the netting process,the following results:

A) Long-term collectible gain of $2,000.

B) LTCG of $6,000,Long-term collectible gain of $2,000,and a STCL of $6,000.

C) LTCG of $6,000,Long-term collectible gain of $2,000,and a STCL carryover to 2011 of $3,000.

D) LTCG of $2,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Warren,age 17,is claimed as a dependent by

Q43: Millie,age 80,is supported during the current year

Q44: In terms of the tax formula applicable

Q45: Wilma is a widow,age 80 and blind,who

Q49: During 2010,Anna had the following transactions: <img

Q50: Since an abandoned spouse is considered to

Q52: Heloise,age 74 and a widow,is claimed as

Q55: A dependent cannot claim a personal exemption

Q82: Because they appear on page 1 of

Q127: Mel is not quite sure whether an