Multiple Choice

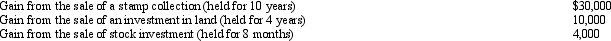

Perry is in the 33% tax bracket.During 2010,he had the following capital asset transactions:  Perry's tax consequences from these gains are as follows:

Perry's tax consequences from these gains are as follows:

A) (15% * $10,000) + (28% * $30,000) + (33% * $4,000) .

B) (15% * $30,000) + (33% * $4,000) .

C) (0% * $10,000) + (28% * $30,000) + (33% * $4,000) .

D) (15% * $40,000) + (33% * $4,000) .

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q59: An above-the-line deduction refers to a deduction

Q62: Tad claims his 70-year-old mother as a

Q64: Merle,age 17,is claimed by her parents as

Q65: Ed is divorced and maintains a home

Q67: The IRS facilitates the filing of income

Q68: For the current year,David has salary income

Q70: After her divorce,Hope continues to support her

Q71: Gene is single and for 2010 has

Q95: Using borrowed funds from a mortgage on

Q117: List at least three exceptions to the