Multiple Choice

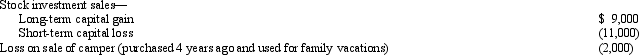

For the current year,David has salary income of $80,000 and the following property transactions:  What is David's AGI for the current year?

What is David's AGI for the current year?

A) $76,000.

B) $77,000.

C) $78,000.

D) $89,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q59: An above-the-line deduction refers to a deduction

Q64: Merle,age 17,is claimed by her parents as

Q65: Ed is divorced and maintains a home

Q66: Perry is in the 33% tax bracket.During

Q67: The IRS facilitates the filing of income

Q70: After her divorce,Hope continues to support her

Q71: Gene is single and for 2010 has

Q72: Derek,age 46,is a surviving spouse.If he has

Q73: Pablo is married to Elena,who lives with

Q95: Using borrowed funds from a mortgage on