Multiple Choice

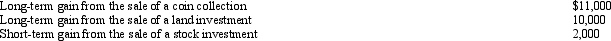

Kirby is in the 15% tax bracket and had the following capital asset transactions during 2010:  Kirby's tax consequences from these gains are as follows:

Kirby's tax consequences from these gains are as follows:

A) (5% * $10,000) + (15% * $13,000) .

B) (0% * $10,000) + (15% * $13,000) .

C) (15% * $13,000) + (28% * $11,000) .

D) (15% * $23,000) .

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: During the year, Kim sold the following

Q94: Gain on the sale of collectibles held

Q96: Dan and Donna are husband and wife

Q97: Emily,whose husband died in December 2010,maintains a

Q98: In some cases,the tax on long-term capital

Q100: Karen had the following transactions for 2010:<br>

Q101: In 2010,Ed is 66 and single.If he

Q102: The filing status of a taxpayer (e.g.

Q103: Roy and Linda were divorced in 2009.The

Q104: Kim,a resident of Oregon,supports his parents who