Essay

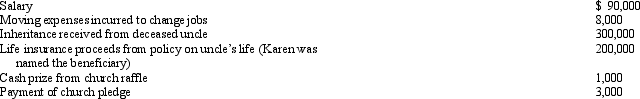

Karen had the following transactions for 2010:

What is Karen's AGI for 2010?

What is Karen's AGI for 2010?

Correct Answer:

Verified

$83,000.$90,000 (salary)+ $1,000 (raffle...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$83,000.$90,000 (salary)+ $1,000 (raffle...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q17: During the year, Kim sold the following

Q96: Dan and Donna are husband and wife

Q97: Emily,whose husband died in December 2010,maintains a

Q98: In some cases,the tax on long-term capital

Q99: Kirby is in the 15% tax bracket

Q101: In 2010,Ed is 66 and single.If he

Q102: The filing status of a taxpayer (e.g.

Q103: Roy and Linda were divorced in 2009.The

Q104: Kim,a resident of Oregon,supports his parents who

Q105: Currently,the top Federal income tax rate in