Multiple Choice

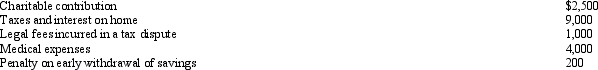

Janice is single,had gross income of $38,000,and incurred the following expenses:  Her AGI is:

Her AGI is:

A) $21,300.

B) $28,800.

C) $32,800.

D) $35,500.

E) $37,800.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Salaries are considered an ordinary and necessary

Q3: What are the relevant factors to be

Q17: Are there any circumstances under which lobbying

Q19: Graham, a CPA, has submitted a proposal

Q34: Which of the following is deductible as

Q35: Edward operates an illegal drug-running business and

Q40: A moving expense that is reimbursed by

Q44: The salaries of the top seven executives

Q87: What losses are deductible by an individual

Q96: Hobby activity expenses are deductible from AGI