Essay

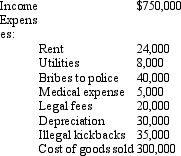

Edward operates an illegal drug-running business and has the following items of income and expense.What is Edward's adjusted gross income from this operation?

Correct Answer:

Verified

He is allowed to deduct only t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

He is allowed to deduct only t...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q2: Salaries are considered an ordinary and necessary

Q3: What are the relevant factors to be

Q11: Assuming an activity is deemed to be

Q30: Which of the following is a deduction

Q33: Which of the following cannot be deducted

Q34: Which of the following is deductible as

Q39: Janice is single,had gross income of $38,000,and

Q40: A moving expense that is reimbursed by

Q96: Hobby activity expenses are deductible from AGI

Q107: How can an individual's consultation with a