Multiple Choice

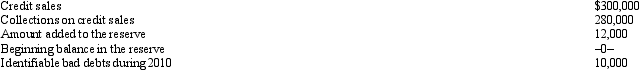

Swan,Inc.is an accrual basis taxpayer.Swan uses the aging approach to calculate the reserve for bad debts.During 2010,the following occur associated with bad debts.  The amount of the deduction for bad debt expense for Swan for 2010 is:

The amount of the deduction for bad debt expense for Swan for 2010 is:

A) $10,000.

B) $12,000.

C) $20,000.

D) $22,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: If a vacation home is determined to

Q6: Benita incurred a business expense on December

Q8: Expenses incurred in a trade or business

Q12: Iris,a calendar year cash basis taxpayer,owns and

Q13: Agnes is the sole shareholder of Violet,Inc.For

Q14: Kitty runs a brothel (illegal under state

Q15: Beulah's personal residence has an adjusted basis

Q54: If an activity involves horses, a profit

Q81: Briefly discuss the two tests that an

Q87: Under what circumstances may a taxpayer deduct