Essay

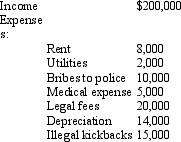

Kitty runs a brothel (illegal under state law)and has the following items of income and expense.What is the amount that she must include in taxable income from her operation?

Correct Answer:

Verified

The bribes to polic...

The bribes to polic...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Swan,Inc.is an accrual basis taxpayer.Swan uses the

Q12: Iris,a calendar year cash basis taxpayer,owns and

Q13: Agnes is the sole shareholder of Violet,Inc.For

Q15: Beulah's personal residence has an adjusted basis

Q16: Nikeya sells land (adjusted basis of $60,000)to

Q17: Which of the following must be capitalized

Q18: All expenses associated with the production of

Q19: If a vacation home is used for

Q54: If an activity involves horses, a profit

Q81: Briefly discuss the two tests that an