Multiple Choice

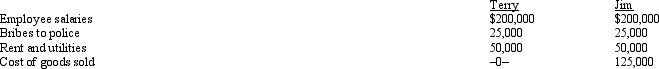

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

A) Neither Terry nor Jim can deduct any of the above items in calculating the business profit.

B) Terry should report profit from his business of $250,000.

C) Jim should report profit from his business of $500,000.

D) Jim should report profit from his business of $250,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: If a vacation home is classified as

Q22: If a taxpayer cannot satisfy the three-out-of-five

Q79: Irene and Jim own an unincorporated bakery.They

Q80: A vacation home rented for 200 days

Q81: Arnold and Beth file a joint return.Use

Q82: On January 2,2010,Fran acquires a business from

Q85: Only certain employment related expenses are classified

Q87: Clark operates a gambling operation,which is an

Q88: Marvin spends the following amounts on a

Q89: The concept of reasonableness applies not only