Essay

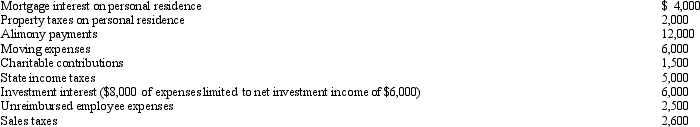

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Correct Answer:

Verified

Arnold and Beth's deduction for AGI is $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Arnold and Beth's deduction for AGI is $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q7: If a vacation home is classified as

Q22: If a taxpayer cannot satisfy the three-out-of-five

Q55: Under the "one-year rule" for the current

Q76: For an expense to be deducted,the amount

Q77: During the year,Larry rented his vacation home

Q79: Irene and Jim own an unincorporated bakery.They

Q80: A vacation home rented for 200 days

Q82: On January 2,2010,Fran acquires a business from

Q84: Terry and Jim are both involved in

Q85: Only certain employment related expenses are classified