Multiple Choice

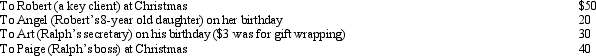

Ralph made the following business gifts during the year.  Presuming proper substantiation,Ralph's deduction is:

Presuming proper substantiation,Ralph's deduction is:

A) $53.

B) $73.

C) $78.

D) $98.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: A taxpayer who lives and works in

Q16: In terms of income tax treatment, what

Q50: For tax purposes, a statutory employee is

Q66: One indicia of independent contractor (rather than

Q67: Ramon and Ingrid work in the field

Q68: If an individual is ineligible to make

Q69: Statutory employees:<br>A)Report their expenses on Form 2106.<br>B)Include

Q73: Distributions from a Roth IRA that are

Q74: Brian makes gifts as follows:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2201/.jpg"

Q102: Qualifying job search expenses are deductible even