Essay

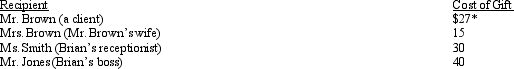

Brian makes gifts as follows:

* Includes $2 for engraving

* Includes $2 for engraving

Presuming adequate substantiation and no reimbursement,how much may Brian deduct?

Correct Answer:

Verified

$52 ($27 + $25).The deduction for Mr.Bro...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A taxpayer who lives and works in

Q16: In terms of income tax treatment, what

Q50: For tax purposes, a statutory employee is

Q69: Statutory employees:<br>A)Report their expenses on Form 2106.<br>B)Include

Q70: Ralph made the following business gifts during

Q76: Regarding § 222 (qualified higher education deduction

Q77: Unfortunately,the IRS will not issue advanced rulings

Q102: Qualifying job search expenses are deductible even

Q125: The work-related expenses of an independent contractor

Q161: If the cost of uniforms is deductible,