Multiple Choice

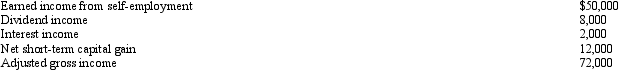

Susan is a self-employed accountant with a qualified defined contribution plan (a Keogh plan) .She has the following income items for the year:  What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2010,assuming the self-employment tax rate is 15.3%?

What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2010,assuming the self-employment tax rate is 15.3%?

A) $9,235.

B) $12,000.

C) $46,000.

D) $46,468.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Tom owns and operates a lawn maintenance

Q47: Contributions to a Roth IRA can be

Q49: As to meeting the time test for

Q50: Monica has education expenses that qualify for

Q51: The maximum annual elective contribution for a

Q53: Kelly,an unemployed architect,moves from Boston to Phoenix

Q54: During the year,Walt went from Louisville to

Q55: The § 222 deduction for tuition and

Q56: An individual,age 40,who is not subject to

Q85: Jake performs services for Maude. If Jake