Multiple Choice

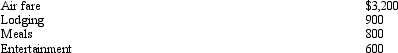

During the year,Walt went from Louisville to Hawaii on business.Preceding a five-day business meeting,he spent four days vacationing at the beach.Excluding the vacation costs,his expenses for the trip are:  Presuming no reimbursement,deductible expenses are:

Presuming no reimbursement,deductible expenses are:

A) $5,500.

B) $4,800.

C) $3,900.

D) $3,200.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Tom owns and operates a lawn maintenance

Q49: As to meeting the time test for

Q50: Monica has education expenses that qualify for

Q51: The maximum annual elective contribution for a

Q52: Susan is a self-employed accountant with a

Q53: Kelly,an unemployed architect,moves from Boston to Phoenix

Q55: The § 222 deduction for tuition and

Q56: An individual,age 40,who is not subject to

Q59: A taxpayer just changed jobs and incurred

Q81: There is no cutback adjustment for meals