Essay

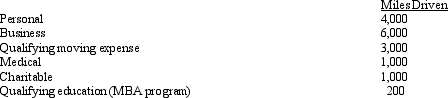

Gus uses his automobile for both business and personal use and claims the automatic mileage rate for all purposes.During 2010,his mileage was as follows:

How much can Gus claim for mileage?

How much can Gus claim for mileage?

Correct Answer:

Verified

$3,900 [(6,200 miles * $0.50,b...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: A worker may prefer to be classified

Q81: Discuss the 2%-of-AGI floor and the 50%

Q83: Elaine, the regional sales director for a

Q84: Which,if any,of the following is subject to

Q86: A taxpayer who lives and works in

Q87: Ryan performs services for Jordan.Which,if any,of the

Q88: Rachel lives and works in Chicago.She is

Q106: Myra's classification of those who work for

Q125: The work-related expenses of an independent contractor

Q161: If the cost of uniforms is deductible,