Essay

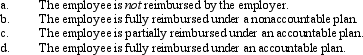

Discuss the 2%-of-AGI floor and the 50% cutback limitation in connection with various employee expenses under the following arrangements:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q76: Regarding § 222 (qualified higher education deduction

Q77: Unfortunately,the IRS will not issue advanced rulings

Q80: A worker may prefer to be classified

Q83: Gus uses his automobile for both business

Q83: Elaine, the regional sales director for a

Q84: Which,if any,of the following is subject to

Q86: A taxpayer who lives and works in

Q106: Myra's classification of those who work for

Q125: The work-related expenses of an independent contractor

Q161: If the cost of uniforms is deductible,