Essay

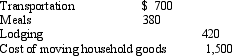

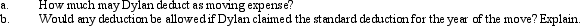

After graduating from college,Dylan obtained employment in Boston.In moving from his parents' home in Wichita to Boston,Dylan incurred the following expenses:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q24: Marvin lives with his family in Alabama.

Q127: Under the actual expense method,which,if any,of the

Q128: During 2010,Tracy used her car as follows:

Q129: Meg teaches the fifth grade at a

Q130: In terms of the deductibility of military

Q133: In terms of meeting the distance test

Q134: Bill is the regional manager for a

Q135: A participant has a zero basis in

Q136: Crow Corporation pays for a trip to

Q137: Amy works as an auditor for a