Multiple Choice

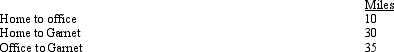

Amy works as an auditor for a large major CPA firm.During the months of September through November of each year,she is permanently assigned to the team auditing Garnet Corporation.As a result,every day she drives from her home to Garnet and returns home after work.Mileage is as follows:  For these three months,Amy's deductible mileage for each workday is:

For these three months,Amy's deductible mileage for each workday is:

A) 0.

B) 30.

C) 35.

D) 60.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: A participant who is at least age

Q132: After graduating from college,Dylan obtained employment in

Q133: In terms of meeting the distance test

Q134: Bill is the regional manager for a

Q135: A participant has a zero basis in

Q136: Crow Corporation pays for a trip to

Q138: The total of traditional deductible,traditional nondeductible,and Roth

Q139: Donna,age 27 and unmarried,is an active participant

Q141: After the automatic mileage rate has been

Q142: During the year,Oscar travels from Raleigh to