Essay

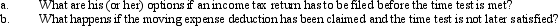

A taxpayer just changed jobs and incurred unreimbursed moving expenses.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Tom owns and operates a lawn maintenance

Q24: In the case of an office in

Q54: During the year,Walt went from Louisville to

Q55: The § 222 deduction for tuition and

Q56: An individual,age 40,who is not subject to

Q60: Brandi moved from New York City to

Q61: A moving expense deduction is not allowed

Q62: If a business retains someone to provide

Q63: In contrasting the reporting procedures of employees

Q81: There is no cutback adjustment for meals