Multiple Choice

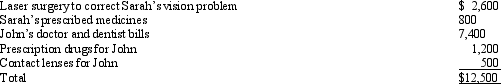

Sarah,John's daughter who would otherwise qualify as his dependent,filed a joint return with her husband Larry.John,who had AGI of $100,000,paid the following medical expenses:  John has a medical expense deduction of:

John has a medical expense deduction of:

A) $1,600.

B) $5,000.

C) $9,100.

D) $12,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Phil is advised by his family physician

Q33: Dawn sold her personal residence to Kevin

Q36: Ron and Tom are equal owners in

Q39: Jennifer,who is single and whose MAGI is

Q42: Emily, who lives in Indiana, volunteered to

Q43: For all of the current year, Randy

Q48: If certain conditions are met, a buyer

Q61: Letha incurred a $1,600 prepayment penalty to

Q63: During the year, Victor spent $300 on

Q89: Excess charitable contributions that come under the