Multiple Choice

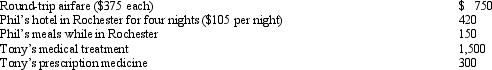

Phil is advised by his family physician that his dependent son,Tony,needs surgery for a benign tumor in his leg.Phil and his son travel to Rochester,Minnesota,for in-patient treatment at the Mayo Clinic,which specializes in this type of surgery.Phil incurred the following costs:  Compute Phil's medical expenses for the trip (before the 7.5% floor) .

Compute Phil's medical expenses for the trip (before the 7.5% floor) .

A) $2,550.

B) $2,750.

C) $2,970.

D) $3,120.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Donald owns a principal residence in Chicago,

Q27: Nick made the following contributions this year

Q33: Dawn sold her personal residence to Kevin

Q35: Sarah,John's daughter who would otherwise qualify as

Q36: Ron and Tom are equal owners in

Q43: For all of the current year, Randy

Q48: If certain conditions are met, a buyer

Q61: Letha incurred a $1,600 prepayment penalty to

Q89: Excess charitable contributions that come under the

Q91: Which of the following items would be