Multiple Choice

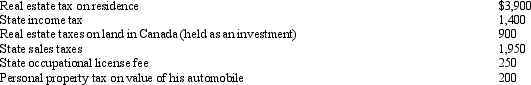

During 2010,Sam,a self-employed individual,paid the following amounts:  What amount can Sam claim as taxes in itemizing deductions from AGI?

What amount can Sam claim as taxes in itemizing deductions from AGI?

A) $6,600.

B) $6,950.

C) $7,200.

D) $8,600.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: During the current year, Maria and her

Q9: A taxpayer pays points to obtain financing

Q11: On December 23,2010,Megan used her credit card

Q14: In 2010,Roseann makes the following donations to

Q15: In 2010,Barry pays a $3,000 premium for

Q16: Diane contributed a parcel of land to

Q17: Wilma,who uses the cash method of accounting,lives

Q37: During the year, Eve (a resident of

Q53: Pedro's child attends a school operated by

Q98: Fees for automobile inspections, automobile titles and