Multiple Choice

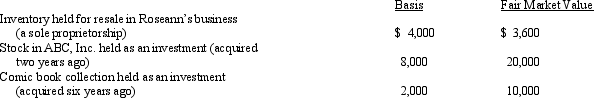

In 2010,Roseann makes the following donations to qualified charitable organizations:  The ABC stock and the inventory were given to Roseann's church,and the comic book collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Roseann's charitable contribution deduction for 2010 is:

The ABC stock and the inventory were given to Roseann's church,and the comic book collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Roseann's charitable contribution deduction for 2010 is:

A) $14,000.

B) $25,600.

C) $26,000.

D) $33,600.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: A taxpayer pays points to obtain financing

Q11: On December 23,2010,Megan used her credit card

Q13: During 2010,Sam,a self-employed individual,paid the following amounts:

Q15: In 2010,Barry pays a $3,000 premium for

Q16: Diane contributed a parcel of land to

Q17: Wilma,who uses the cash method of accounting,lives

Q19: Larry and Beth are married and together

Q37: During the year, Eve (a resident of

Q53: Pedro's child attends a school operated by

Q98: Fees for automobile inspections, automobile titles and