Multiple Choice

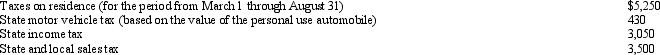

Nancy paid the following taxes during the year:  Nancy sold her personal residence on June 30,under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for Nancy?

Nancy sold her personal residence on June 30,under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for Nancy?

A) $9,180.

B) $9,130.

C) $7,382.

D) $5,382.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: David, a single taxpayer, took out a

Q59: In applying the percentage limitations, carryovers of

Q66: Contributions to public charities in excess of

Q75: Walter traveled to another city to obtain

Q76: Bjorn contributed a sculpture to the Norwegian

Q78: Bob sold a personal residence to Fred

Q81: Ed paid $1,660 of medical expenses for

Q83: In 2011,Rhonda received an insurance reimbursement for

Q84: George is single and has AGI of

Q88: For purposes of computing the deduction for