Essay

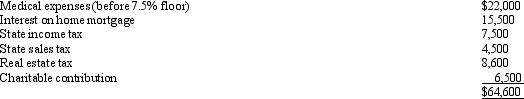

George is single and has AGI of $262,450 in 2010.His potential itemized deductions before any limitations for the year total $64,600 and consist of the following:

After all necessary adjustments are made,what is the amount of itemized deductions George may claim?

After all necessary adjustments are made,what is the amount of itemized deductions George may claim?

Correct Answer:

Verified

The medical expense deduction ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Mindy paid an appraiser to determine how

Q59: In applying the percentage limitations, carryovers of

Q66: Contributions to public charities in excess of

Q80: Nancy paid the following taxes during the

Q81: Ed paid $1,660 of medical expenses for

Q83: In 2011,Rhonda received an insurance reimbursement for

Q87: Manny developed a severe heart condition,and his

Q88: For purposes of computing the deduction for

Q88: Lonnie developed severe arthritis and was unable

Q89: Wendy,who is single,travels frequently on business.Brent,Wendy's 84-year-old