Multiple Choice

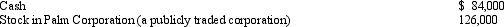

Nick made the following contributions this year to the University of the West:  Nick acquired the stock in Palm Corporation as an investment two years ago at a cost of $56,000.Nick's current AGI is $252,000.What is Nick's current charitable contribution deduction?

Nick acquired the stock in Palm Corporation as an investment two years ago at a cost of $56,000.Nick's current AGI is $252,000.What is Nick's current charitable contribution deduction?

A) $75,600.

B) $84,000.

C) $126,000.

D) $210,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Donald owns a principal residence in Chicago,

Q22: Martha drove 200 miles to volunteer in

Q24: Carolyn mailed a check for $1,000 to

Q26: Linda borrowed $60,000 from her parents for

Q32: Phil is advised by his family physician

Q56: Upon the recommendation of a physician, Ed

Q61: Letha incurred a $1,600 prepayment penalty to

Q78: In order to dissuade his pastor from

Q89: Excess charitable contributions that come under the

Q91: Which of the following items would be