Essay

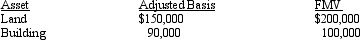

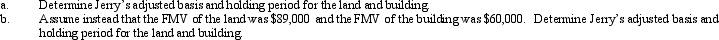

On September 18,2010,Jerry received land and a building from Ted as a gift.Ted had purchased the land and building on March 5,2007,and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

Correct Answer:

Verified

The basis is allocated to the land and ...

The basis is allocated to the land and ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: What is the general formula for calculating

Q39: Hubert purchases Fran's jewelry store for $950,000.The

Q40: Melissa,age 58,marries Arnold,age 50,on June 1,2010.Melissa decides

Q46: Lucinda,a calendar year taxpayer,owned a rental property

Q47: Marge purchases the Kentwood Krackers,a AAA level

Q48: Katrina,age 58,rented (as a tenant)the house that

Q65: After 5 years of marriage, Dave and

Q133: Discuss the relationship between realized gain and

Q206: Discuss the relationship between the postponement of

Q243: Tariq sold certain U.S. Government bonds and