Essay

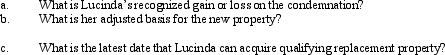

Lucinda,a calendar year taxpayer,owned a rental property with an adjusted basis of $215,000 in a major coastal city.When her property was condemned by the city government on November 5,2010,in order to build a convention center,Lucinda eventually received qualified replacement property from the city government on February 5,2011.This new property has a fair market value of $350,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: What is the general formula for calculating

Q18: Lois received nontaxable stock rights with a

Q44: On September 18,2010,Jerry received land and a

Q47: Marge purchases the Kentwood Krackers,a AAA level

Q48: Katrina,age 58,rented (as a tenant)the house that

Q51: Can dividend treatment result to a shareholder

Q65: After 5 years of marriage, Dave and

Q133: Discuss the relationship between realized gain and

Q206: Discuss the relationship between the postponement of

Q243: Tariq sold certain U.S. Government bonds and