Essay

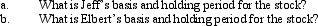

Elbert gives stock worth $28,000 (no gift tax resulted)to his friend,Jeff,on June 8,2010.Elbert purchased the stock on September 1,2003,and his adjusted basis is $22,000.Jeff dies on December 8,2011,and bequeaths the stock to Elbert.At that date,the fair market value of the stock is $31,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Nigel purchased a blending machine for $125,000

Q54: Albert is considering two options for selling

Q55: Vicki sells a parcel of land to

Q56: Taxpayer's principal residence is destroyed by a

Q56: Mitchell owned an SUV that he had

Q58: Eunice Jean exchanges land held for investment

Q61: Sandy and Greta form Tan,Inc.by transferring the

Q62: Seth and Cheryl,husband and wife,own property jointly.The

Q84: Describe the relationship between the recovery of

Q94: Under what circumstances will a distribution by