Essay

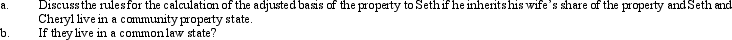

Seth and Cheryl,husband and wife,own property jointly.The property has an adjusted basis of $25,000 and a fair market value of $30,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q56: Mitchell owned an SUV that he had

Q57: Elbert gives stock worth $28,000 (no gift

Q58: Eunice Jean exchanges land held for investment

Q61: Sandy and Greta form Tan,Inc.by transferring the

Q63: Rose's manufacturing plant is destroyed by fire

Q64: For the following exchanges,indicate which qualify as

Q65: Ashley sells investment land (adjusted basis of

Q66: Amanda uses a delivery van in her

Q94: Under what circumstances will a distribution by

Q208: Discuss the logic for mandatory deferral of