Essay

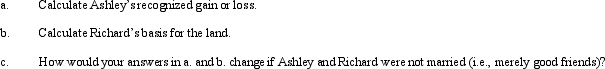

Ashley sells investment land (adjusted basis of $145,000)that she has owned for 4 years to her husband,Richard,for its fair market value of $125,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: Under what circumstances may a partial §

Q61: Sandy and Greta form Tan,Inc.by transferring the

Q62: Seth and Cheryl,husband and wife,own property jointly.The

Q63: Rose's manufacturing plant is destroyed by fire

Q64: For the following exchanges,indicate which qualify as

Q66: Amanda uses a delivery van in her

Q69: Taxpayer acquired a personal residence ten years

Q94: Under what circumstances will a distribution by

Q153: Ollie owns a personal use car for

Q208: Discuss the logic for mandatory deferral of