Multiple Choice

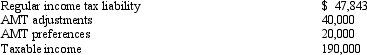

Meg,who is single and age 36,provides you with the following information from her financial records.  Calculate her AMT exemption for 2010.

Calculate her AMT exemption for 2010.

A) $1,143.

B) $27,325.

C) $46,700.

D) $47,843.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: Negative AMT adjustments for the current year

Q63: In 2010 and under § 1202,Jordan excludes

Q64: Use the following selected data to calculate

Q65: Assuming no phaseout,the AMT exemption amount for

Q66: Danica owned a car that she used

Q69: Frances,who had AGI of $100,000,itemized her deductions

Q71: Kay had percentage depletion of $82,000 for

Q72: Mauve,Inc. ,has the following for 2009,2010,and 2011

Q78: How can the positive AMT adjustment for

Q93: Identify an AMT adjustment that applies for