Multiple Choice

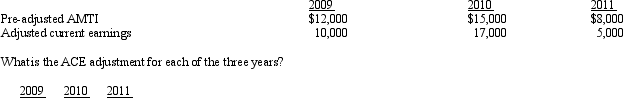

Mauve,Inc. ,has the following for 2009,2010,and 2011 and no prior ACE adjustments.

A) $0 $1,500 ($1,500)

B) ($2,000) $2,000 ($3,000)

C) $2,000 ($2,000) $3,000

D) ($1,500) $1,500 $2,250

E) $1,500 ($1,500) ($2,250)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: Negative AMT adjustments for the current year

Q32: Which of the following statements is correct?<br>A)A

Q67: Meg,who is single and age 36,provides you

Q69: Frances,who had AGI of $100,000,itemized her deductions

Q71: Kay had percentage depletion of $82,000 for

Q74: Which of the following statements is correct?<br>A)The

Q75: Kay,who is single,had taxable income of $0

Q78: How can the positive AMT adjustment for

Q85: If the regular income tax deduction for

Q127: What is the relationship between taxable income