Essay

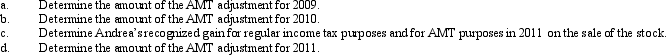

In May 2009,Egret,Inc.issues options to Andrea,a corporate officer,to purchase 200 shares of Egret stock under an ISO plan.At the date the stock options are issued,the fair market value of the stock is $900 per share and the option price is $1,200 per share.The stock becomes freely transferable in 2010.Andrea exercises the options in November 2009 when the stock is selling for $1,600 per share.She sells the stock in December 2011 for $1,800 per share.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Is it possible that no AMT adjustment

Q13: Are the AMT rates for the individual

Q103: Medical expenses are reduced by 10% of

Q104: Omar acquires used 7-year personal property for

Q105: Caroline and Clint are married,have no dependents,and

Q106: Factors that can cause the adjusted basis

Q107: Agnes is able to reduce her regular

Q108: Interest on a home equity loan may

Q109: Marvin,the vice president of Lavender,Inc. ,exercises stock

Q113: The AMT can be calculated using either