Essay

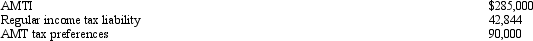

Caroline and Clint are married,have no dependents,and file a joint return in 2010.Use the following selected data to calculate their Federal income tax liability.

Correct Answer:

Verified

The AMT is calculated as follows:

Not...

Not...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Are the AMT rates for the individual

Q100: If the AMT base is not greater

Q101: Prior to the effect of the tax

Q102: Which of the following statements is correct?<br>A)The

Q103: Medical expenses are reduced by 10% of

Q104: Omar acquires used 7-year personal property for

Q106: Factors that can cause the adjusted basis

Q107: Agnes is able to reduce her regular

Q108: In May 2009,Egret,Inc.issues options to Andrea,a corporate

Q109: Marvin,the vice president of Lavender,Inc. ,exercises stock