Multiple Choice

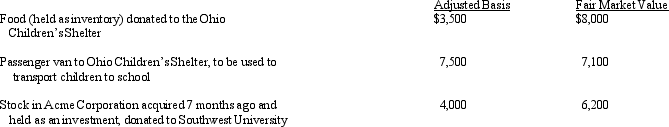

Grocer Services Corporation (a calendar year taxpayer) ,a wholesale distributor of food,made the following donations to qualified charitable organizations during the year:  How much qualifies for the charitable contribution deduction?

How much qualifies for the charitable contribution deduction?

A) $15,000.

B) $16,850.

C) $17,250.

D) $19,450.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: A corporation with $10 million or more

Q17: Unlike individual taxpayers, corporate taxpayers do not

Q94: Schedule M-1 of Form 1120 is used

Q96: On April 8,2010,Oriole Corporation donated a painting

Q97: Ted is the sole shareholder of a

Q99: Compare the basic tax and nontax factors

Q100: Nicole owns and operates a sole proprietorship.She

Q101: Maroon Company had $150,000 net profit from

Q102: Which of the following statements is incorrect

Q103: Fender Corporation was organized in 2008 and