Essay

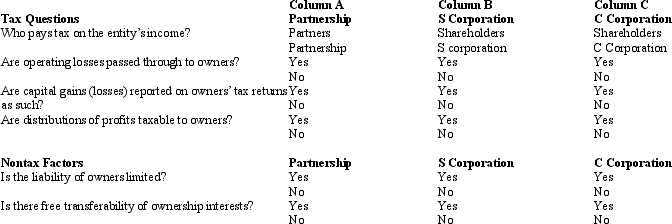

Compare the basic tax and nontax factors of doing business as a partnership,an S corporation,and a C corporation.Circle the correct answers.

Correct Answer:

Verified

The correc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: A corporation with $10 million or more

Q94: Schedule M-1 of Form 1120 is used

Q96: On April 8,2010,Oriole Corporation donated a painting

Q97: Ted is the sole shareholder of a

Q98: Grocer Services Corporation (a calendar year taxpayer),a

Q100: Nicole owns and operates a sole proprietorship.She

Q101: Maroon Company had $150,000 net profit from

Q102: Which of the following statements is incorrect

Q103: Fender Corporation was organized in 2008 and

Q104: Heron Corporation,a calendar year,accrual basis taxpayer,provides the