Essay

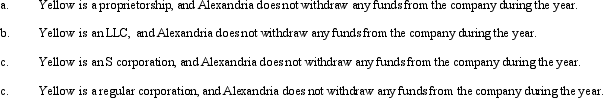

During the current year,Yellow Company had operating income of $380,000 and operating expenses of $300,000.In addition,Yellow had a long-term capital loss of $50,000.Based on this information,how does Alexandria,the sole owner of Yellow Company,report this information on her individual income tax return under following assumptions?

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Income that is included in net income

Q79: Generally,corporate net operating loss can be carried

Q80: A corporation that is not required to

Q82: Azul Corporation,a personal service corporation,had $300,000 of

Q83: As a general rule,a personal service corporation

Q85: During the current year,Quartz Corporation (a calendar

Q86: Schedule M-1 is used to reconcile unappropriated

Q87: Starling Corporation,a closely held personal service corporation,has

Q88: Macayo,Inc. ,received $800,000 life insurance proceeds on

Q89: In the current year,Plum Corporation,a computer manufacturer,donated